General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsDeeDeeNY

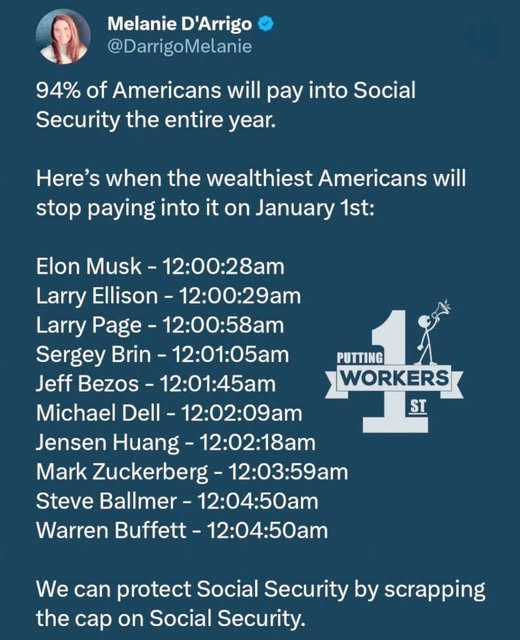

(3,900 posts)Scrapping the cap is the easiest and fairest way to keep Social Security solvent and fully funded going forward.

markodochartaigh

(4,971 posts)going into the pockets of fewer and fewer people. If those people are paying into Social Security on only a tiny portion of their income, it should be obvious that Social Security is going to become weaker and weaker.

COL Mustard

(7,958 posts)Actually pay into Social Security. I know you pay on earned income, but is their income earned or is it something like dividends? I don’t know, but it would be interesting to find out.

I usually hit the cap in late October, and I agree…it should be lifted. There’s no Medicare cap, why isn’t it the same for SSA?

paleotn

(21,487 posts)SheltieLover

(76,513 posts)MerrilyMerrily

(226 posts)Leave the cap where it is for people earning just over the limit, leave a hole for breathing room, and require people making OVER a certain LARGE amount (say, a million? Two?) to pay in to SS again - on the amount earned above that.

Callie1979

(1,111 posts)JT45242

(3,819 posts)You could make an argument that in some excessively high cost of living areas (silicon valley, Seattle, NYC) that $400k is still somewhere in the middle class.

Let the cap rise to close the donut.

Would still protect social security and have the rich pay a fair, if not complete, share of their earnings.

KS Toronado

(22,994 posts)paleotn

(21,487 posts)6.2% and applicable to employee and employer alike on the same dollar of earned income. Make it simple. Apply it to all earned income, no limit, no donat holes. If that exceed revenue targets, lower the rate a bit, but don't over complicate. That's where the US system gets into trouble. A lot of mischief occurs in the rules and exceptions. Just don't go there.

And if you really want to fund Social Security properly, apply the SS to capital gains, particularly carried interest. The most pernicious tax dodge of all.

MichMan

(16,598 posts)Undercuts the argument about fairness.

twodogsbarking

(17,557 posts)mopinko

(73,286 posts)detached from being an insurance/individual benefit.

start paying bennies out of someone else’s money and it becomes a major target. (and yes, i realize current wage earners r paying my benefits.)

i fear the roots of the program r about to b lost and forgotten.

SS was originally meant to be social insurance, i.e. a way to mitigate the risk of poverty in old age.

It's widely popular but support will drop if it becomes explicitly a program for transfer payments.

mopinko

(73,286 posts)paleotn

(21,487 posts)Just like your car, life and homeowners insurance are household costs no different really from your mortgage, rent and groceries. The nomenclature is meaningless. A supposition on my part, but if you think there's some kind of "lock box" somewhere, you're sorely mistaken. Pissed me off every time Al Gore even mentioned those words. Each generation pays the retirement of the prior generation and so on and so on and so on. It's fair and it works. Excess funds are invested in US government securities by law, drawing interest on the debt from general government operations.

Katinfl

(611 posts)Wednesdays

(21,560 posts)lastlib

(27,510 posts)This is a change whose time is long overdue!

jonstl08

(537 posts)Keep the employer cap but eliminate the employee cap. Or you could cut the FICA tax in half for people over the cap so they receive a cut.

JT45242

(3,819 posts)Employers need to pay in as well.

We need to get rid of the loop home for employers who screw over employees by calling them self employed.

My wife likes her boss but he has screwed her out of his share of social security for a dozen years by calling her a contractor and using a 1099. It's bullshit. (Looking at you Uber, door dash, etc)

jonstl08

(537 posts)I said to keep the employer paying until the individual cap is reached. I agree employers do screw over employees by making them independent contractors. I see this every year in the tax office. People told where to work and what time to be there but then are issued a 1099. I tell those clients to contact the IRS and report them because they should be a w2 employee.

PS this happened with a landscaper company. Most of the employees were immigrants. Employer made them independent contractors but they were told where to go and when along with hours they were to be on the job. They were reported and lost. Since the IRS had 1099's it was easy to fine them for back taxes along with social security and medicare. The fine was huge and message was sent. Virtually all employees the next year for landscapers and roofers were W2 employees.